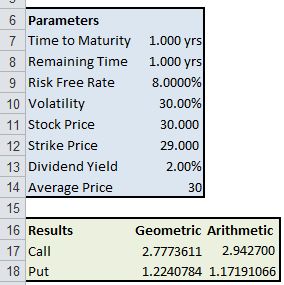

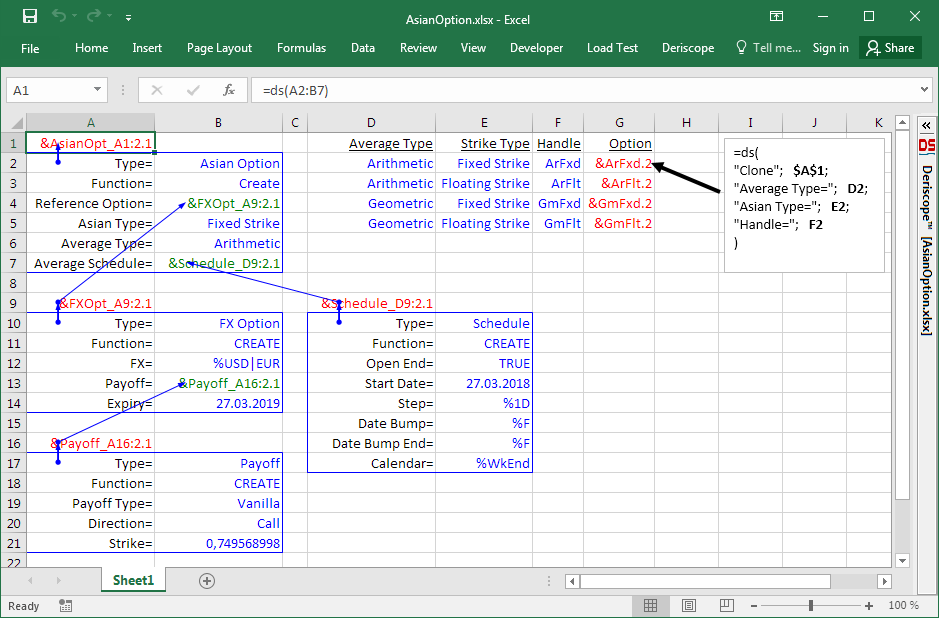

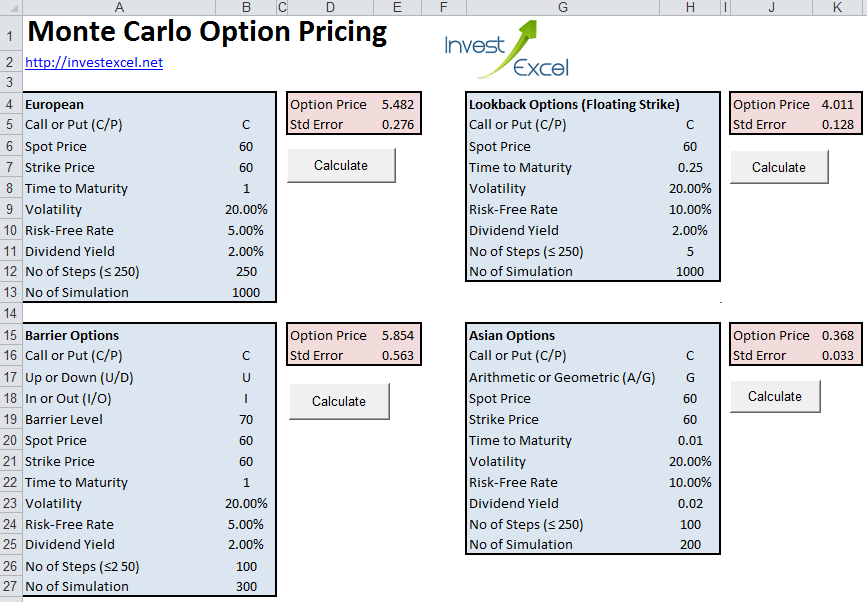

Conversely, however, if an analytical technique for valuing the option exists—or even a numeric technique , such as a modified pricing tree [9] —Monte Carlo methods will usually be too slow to be competitive. Twitter Tweets by investexcel. First, we examine how the two semi-analytical i. This post will simply share the marked up Excel snap shots from the Monte Carlo Simulator to show how the same principals used for pricing vanilla call options can be applied to price more exotic option contracts. It follows that the two approaches complement each other, so that there is always an applicable algorithm which is able to price an Asian option within 5 seconds with a precision of four decimal digits in our perception, this speed and precision is acceptable under most market circumstances. Their history dates from , when they were used to price crude oil derivatives in Tokyo. Cohen, A.

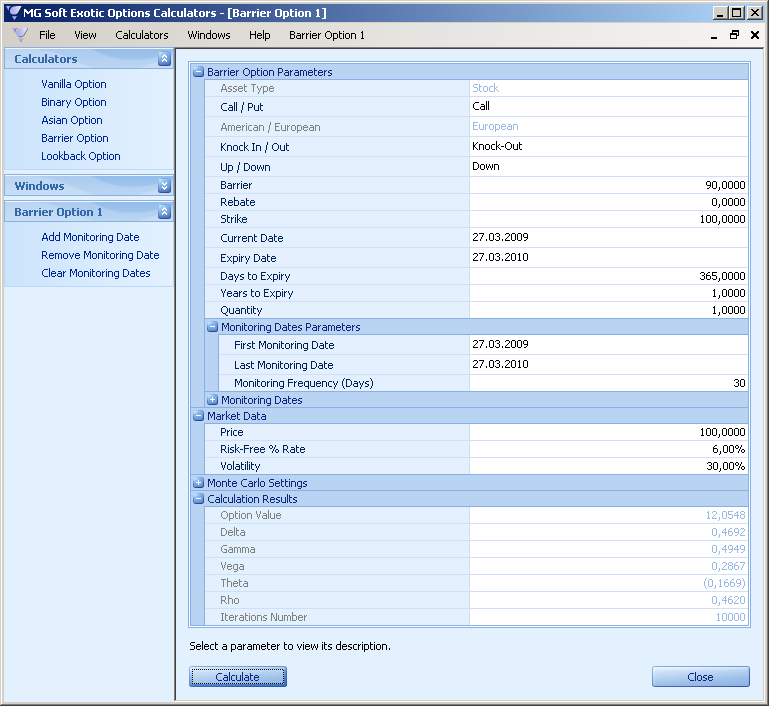

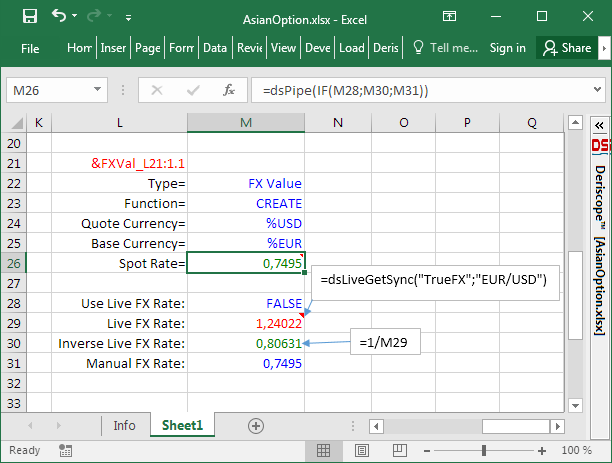

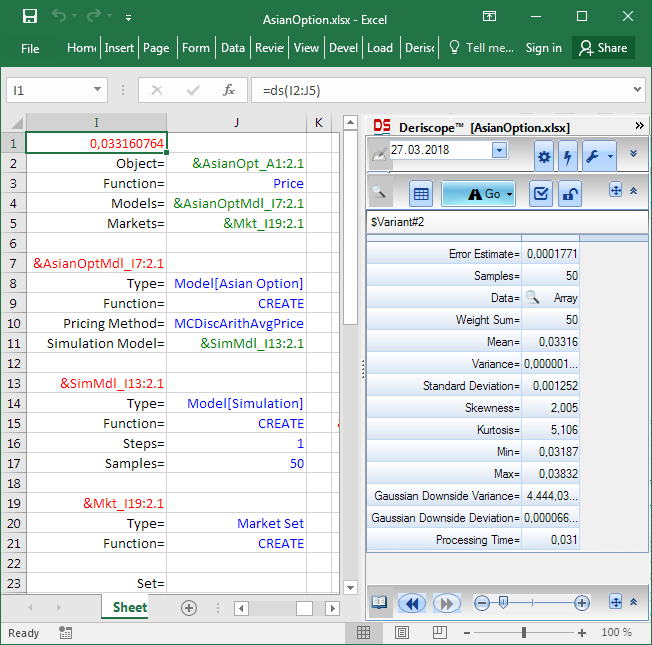

It is crucial to note the advantages of this method:. By using this site, you agree to the Terms of Use and Privacy Policy. In the continuous case. Below this value, the inversion algorithms employed fail to converge, and one has to resort to the simulation approach or make approximations e. In mathematical finance , a Monte Carlo option model uses Monte Carlo methods [Notes 1] to calculate the value of an option with multiple sources of uncertainty or with complicated features. We will simulate a price series, evaluate intermediate values, calculate option payoffs and store the payoff results for a single iteration in an Excel data table. Then, we compare the semi-analytical and the simulation approaches and make suggestions on their appropriate usage in real life situations.